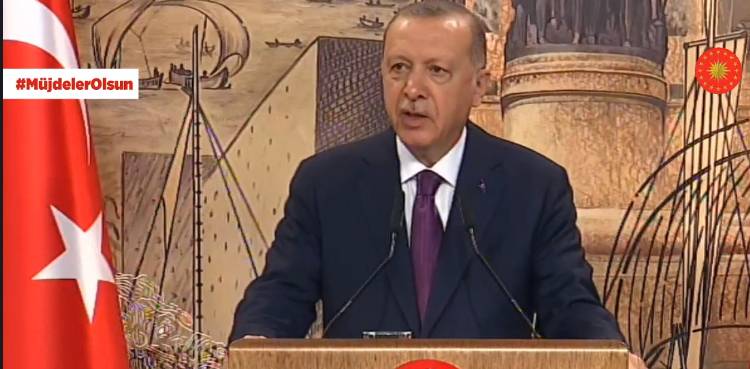

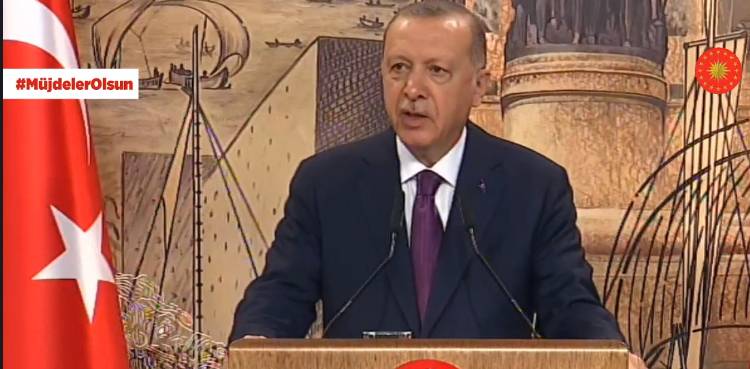

Erdogan ousts central bank governor as Turkish lira slides

ISTANBUL/ANKARA: Turkish President Tayyip Erdogan fired central bank governor Murat Uysal on Saturday and replaced him with ex-finance minister Naci Agbal, acting after a 30% plunge in the lira currency’s value to record lows this year.

The decision to replace Murat Uysal gives Turkey its fourth central bank governor in five years and could stoke longstanding criticism about political interference in monetary policy.

The presidential decree was announced in the early hours Saturday in Turkey’s Official Gazette and gave no reason for the surprise move. A senior official in Erdogan’s AK Party said Uysal was held responsible for the nosedive of the lira, the worst performer in emerging markets this year.

Analysts said that while Agbal is a close Erdogan ally, he is seen as a capable manager who could take a more orthodox approach to policy. That could ease concerns that have driven Turks to snap up hard currencies at record levels.

“Uysal’s leadership had been utterly disastrous. Agbal cannot be worse, surely. He had a reputation as a decent technocrat,” Timothy Ash at BlueBay Asset Management said on Twitter. “Agbal is actually qualified for the job.”

The lira closed at 8.5445 against the dollar on Friday after touching a record low of 8.58, despite dollar weakness as votes were still being counted in the U.S. election.

Erdogan had appointed then-deputy governor Uysal to head the central bank in July 2019 after sacking predecessor Murat Cetinkaya amid the president’s frustration that the bank had not cut interest rates to boost the economy.

Erdogan, a self-described enemy of high interest rates, has repeatedly called for lower borrowing costs. Last weekend, he said Turkey was fighting an economic war against those squeezing it in “the devil’s triangle of interest and exchange rates and inflation”.

Agbal had been finance minister from 2015 until 2018, when he was appointed to head the directorate of presidential strategy and budget.

The AK Party official, speaking on condition of anonymity, said Agbal faced a “difficult test” at his new post, but that he was a “strong name” who could help alleviate some of the pressure on the lira.

“We will see a stronger central bank governor,” the official said. “The steps taken were unable to stop the rise in the exchange rate. Uysal was removed from his post… He received the bill, in a sense,” the official said.

Agbal “will act smart” and is not seen as someone who would accept political direction, the person added. “It is a difficult post, but steps to stop the rapid rise in the exchange rate must be taken.”

Turkey, a G20 country and the largest economy in the Middle East, roared back from a recession last year on the back of surging domestic lending and state support for the lira – until the COVID-19 pandemic.

PRESSURE TO TIGHTEN

The lira’s slide, couple with inflation stuck near 12%, well above the bank’s target of around 5%, has ramped up pressure for tighter policy. Last month the central bank bucked expectations for a big rate hike and held policy steady at 10.25%, triggering sharp losses in the lira.

The bank, which also surprised markets a month earlier when it hiked rates, said it would stick with liquidity measures to tighten money supply. It raised the uppermost rate in its corridor, the late liquidity window, to 14.75% from 13.25%.

But the lira has continued to slide on concerns over the central bank’s depleted FX reserves, negative real rates, monetary independence, and the risk of Western sanctions over Turkish foreign and defence policies.

Analysts are also concerned that U.S.-Turkish relations may come under more strain if Democrat Joe Biden defeats President Donald Trump to become U.S. president.

Erik Meyersson, senior economist at Handelsbank, said that while Uysal had taken the blame for Turkey’s economic woes, it was Erdogan who was “tying” the bank’s hands, adding that the post of central bank governor was “mere puppetry”.

Opposition parties criticised the move, saying it would strengthen Erdogan’s influence and politicise the bank.

“All we were missing was a party-tied central bank, and we got it. The central bank is now the AKP’s,” said Tahsin Tarhan, a lawmaker with the main opposition Republican People’s Party.

Umit Ozlale, chair of development policies at the opposition Iyi Party, said the government was putting “expiration dates” on all bureaucrats to “cover up their own sins”.

The post Erdogan ousts central bank governor as Turkish lira slides appeared first on ARY NEWS.

from International – ARY NEWS https://ift.tt/354OU5y

0 Response to "Erdogan ousts central bank governor as Turkish lira slides"

Post a Comment